WEALTH MANAGEMENT FOR REAL LIFE

Investment Management

At Momentous Wealth Management, our commitment is not just to manage your investments—it's to empower your financial journey with a strategy that stands the test of time.

We evaluate the risks and make informed decisions.

In a financial landscape filled with uncertainty, we acknowledge that there's no mystical guru capable of outguessing the market. We focus on what we can control, employing a robust evidence-based approach to investing that prioritizes each client’s unique situation, broad global diversification, and cost efficiency.

The main pillars of our process:

Customized Portfolio

For each client, we craft a wealth management plan and investment policy statement that is uniquely yours, striking the right balance between risk and return in alignment with your unique financial goals and aspirations. For more on our new client process, check out our New Client Process.

Broad Global Diversification

It has been said that “Diversification is the only free lunch on Wall Street”. Broad diversification globally is at the core of our investment philosophy. Our portfolios typically encompass a mix of US and International stocks and bonds and real estate. This strategic diversification is designed to optimize returns and lower risk in client portfolios. We also believe this is vital to capture long-term positive returns given the random and unpredictable nature of financial markets and illustrated below:

Keeping Costs Low

As Benjamin Franklin wisely put it, "A penny saved is a penny earned." At Momentous Wealth Management, we prioritize cost efficiency by maintaining low fees, emphasizing investments with minimal costs, and reducing overall expenses.

How do we accomplish this? Our portfolios are structured to be exceptionally cost-effective, aiming to minimize fees and taxes. The result? More money stays in your pocket at the end of the day.

An Evidence Based Approach to Investing

At Momentous Wealth Management, we believe in an evidence based approach to investing. This means, we resist the urge to chase the “hot stock” of the day. Instead, we focus on drivers of return that we feel are more predictable and reliable over the long run. Consider the following:

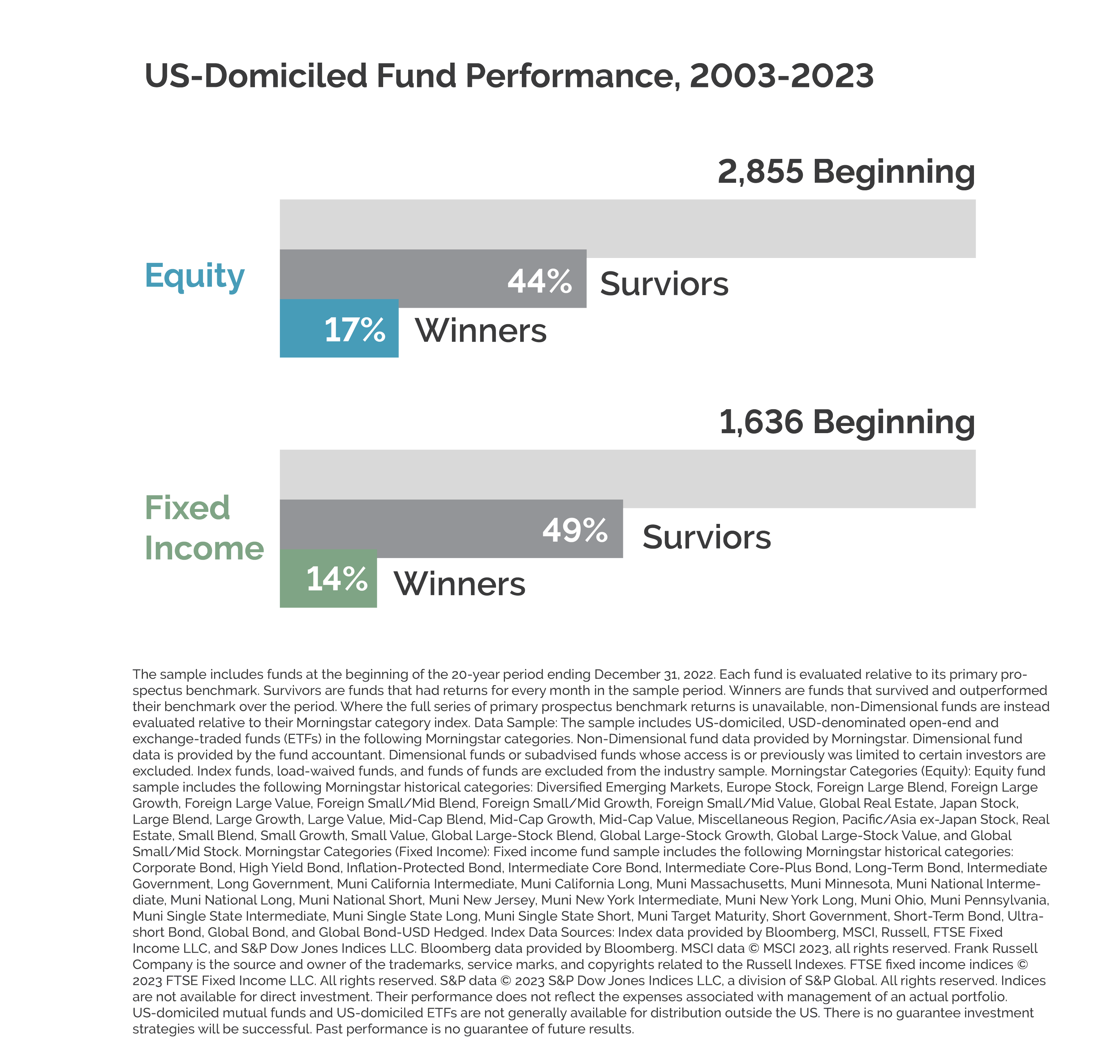

Strategies that try to outguess the market often fail: We believe the market’s pricing power works against managers who try to outperform financial markets through marketing timing. As evidence, only 17% of US stock funds and 14% of fixed income funds have survived and outperformed their benchmarks over the past 20 years.

Resist Chasing Past Performance

Chasing past performance has also proven to be ineffective: Some investors select funds based on their past returns. Yet, past performance offers little insight into a fund’s future returns. As an example, most funds that have performed in the top quartile of previous five year returns were not able to maintain top quartile performance in the following five years.

Let Markets Work for You

Alternatively, letting markets work for you in the long run has proven to be a powerful investment strategy: The financial markets have rewarded long term investors. Investors expect a positive return on the capital they supply, and historically, the equity and bond markets have provided wealth growth that has more than offset inflation over the long term.